Are you feeling overwhelmed by the financial facets of your business’s online presence? A bookkeeping program that accurately tracks and precisely records all payments including sales, expenses and tax obligations is necessary for online stores to succeed. Bookkeeping is useful for preparing accounting reports, filing your tax returns each year, and keeping track of your cash flow.

The success of an e-commerce company involves more than simply excellent products and strategies for marketing. Behind the scenes, careful financial management plays a crucial function in ensuring that the business is profitable and compliance. This article will focus on the key aspects of ecommerce financial management, including accounting, taxation and bookkeeping. Knowing and understanding this aspect is essential to sustain expansion in the ecommerce environment.

Bookkeeping is an essential part of a sound financial management system for ecommerce. It is the process of recording and arranging financial transactions, such as expenses, sales and inventory. By keeping accurate and current information, entrepreneurs in the e-commerce industry gain valuable insights into their company’s financial health. They can track cash flow, and monitor expenditures and sales. For more information, click ecommerce

Effective bookkeeping is essential for all ecommerce companies. Here are a few key ways to simplify your bookkeeping processes:

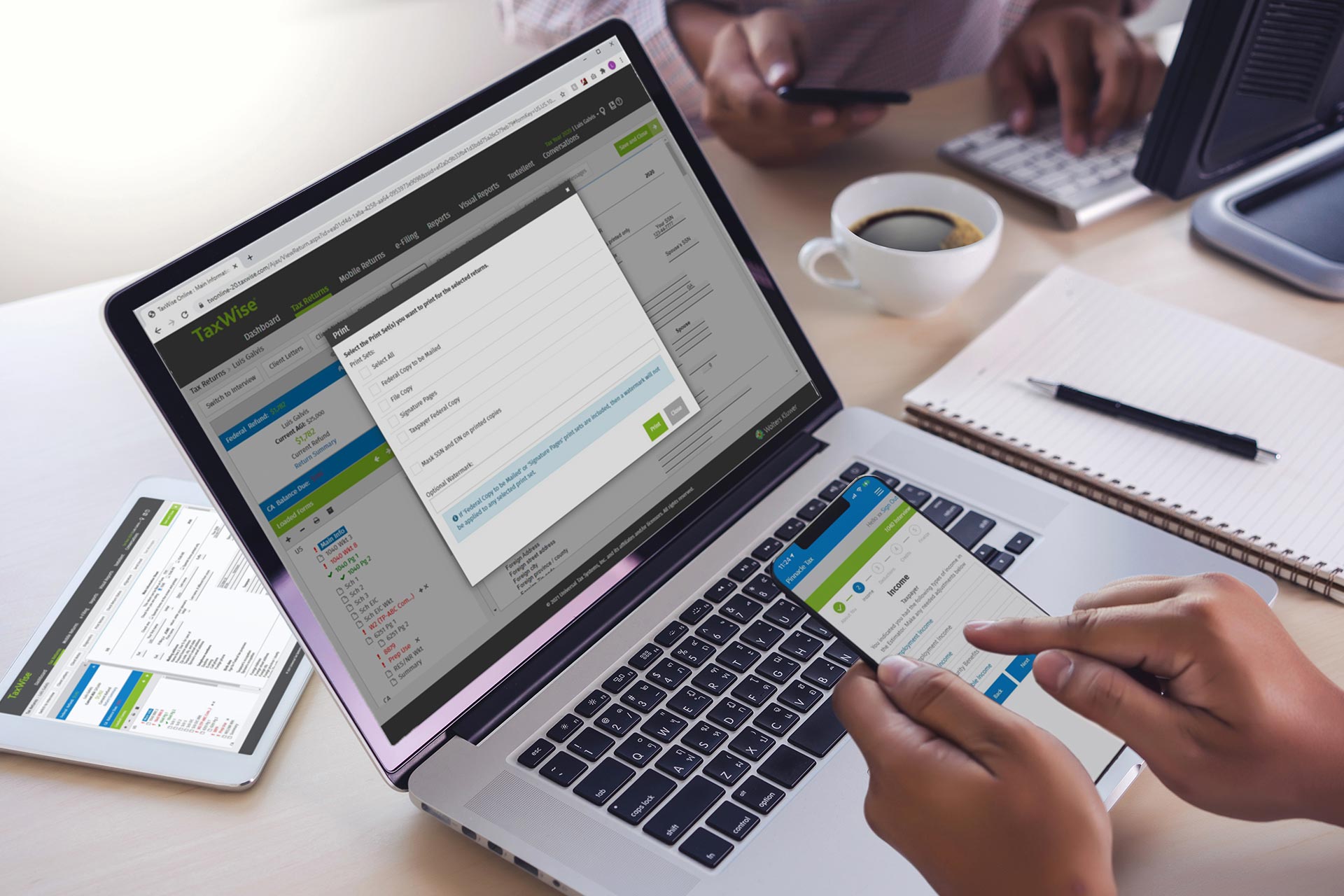

Utilize Accounting Software Use accounting software to purchase specially designed for businesses operating on the internet. These software tools can automate the input of data, generate reports and offer integration with payment gateways, e-commerce platforms and ecommerce platforms.

Separate your personal finances from those of the company. It is essential to separate account for bank and credit card and debit cards. This will simplify the bookkeeping process, makes tax filing and provides the accuracy of your data reporting.

Categorize Transactions: Accurately categorizing transactions helps you understand your revenues and expenses better. Create separate categories for advertising costs, shipping expenses as well as sales and other expenses.

Tax preparation plays a crucial aspect in the financial management of e-commerce. Tax regulations have to be adhered to by companies that sell online. They need to collect and pay sales tax when required and file tax returns that are accurate. Here are some things to take into consideration when filing your taxes.

Sales Tax Compliance: Understand the requirements for sales taxes in the jurisdictions that you offer your product. You should determine if you’ve got nexus, or have a significant presence in the states. If yes, then you will have to collect sales tax and then remit the tax.

Maintain detailed record-keeping: Keep meticulously detailed documentation of all your tax-related transactions. These include expenses, sales and other financial transactions. Include documentation of any exemptions or deductions you might be entitled to.

Contact a tax professional Taxation for eCommerce can be complicated. You should consider consulting with a qualified tax advisor with experience in ecommerce business to ensure accuracy and compliance.

Accounting is more than bookkeeping and tax preparation. It includes analyzing financial information and generating financial reports and providing an overall picture of your company’s performance. Here’s the reason accounting is so important:

Accounting: You can employ accounting to evaluate the financial performance of your business, discover trends, assess profitability and make informed growth decisions.

Budgeting and Forecasting: Accounting assists you prepare budgets, set financial goals, and predict future performance. This allows you to plan strategically and allocate resources efficiently.

Financial Reporting: Creating financial statements, like income statements, balance sheets, as well as cash flow statements lets you reveal your business’s financial status to investors, stakeholders and lenders.

As your company grows and expands, it can be difficult to manage financial issues that are complex. Outsourcing accounting and bookkeeping services is a great option with many advantages.

Expertise & Accuracy: Professional accountants and bookkeepers are experts in the field of e-commerce financials. They can guarantee accurate accounts and financial statements.

Time and Cost Savings Outsourcing lets you focus on core business operations while professional staff handle financial obligations. Outsourcing can be less expensive as compared to hiring staff internally.

It is essential to maximize profits by implementing an accounting system for your online store. Although it can be daunting initially and time-consuming to keep track of all the data required, having a reliable bookkeeping system in place allows you to track your expenses and gain insight into areas that can be improved to increase efficiency and increase sales. Professional accounting assistance can help in the creation of a bookkeeping system that will put your company on the path to success. If you’re overwhelmed or don’t have the resources you need and need help, seek out assistance from a trusted service. This can open up a new world of possibilities which can help your business both in the present and in the future. Don’t wait around! Utilize these vital resources today and employ them to increase your business’s profits as never before!