In the financial markets day trading is a popular option because it lets traders benefit from the fluctuations in prices that happen on a short-term basis. For those who utilize Ninjatrader having the right tools will help significantly in the success of trading. This article provides a comprehensive review of Ninjatrader’s trading indicators and signals, along with strategies and strategies and. It’s suitable for both novice and experienced traders.

Understanding Ninjatrader Day Trading Indicators

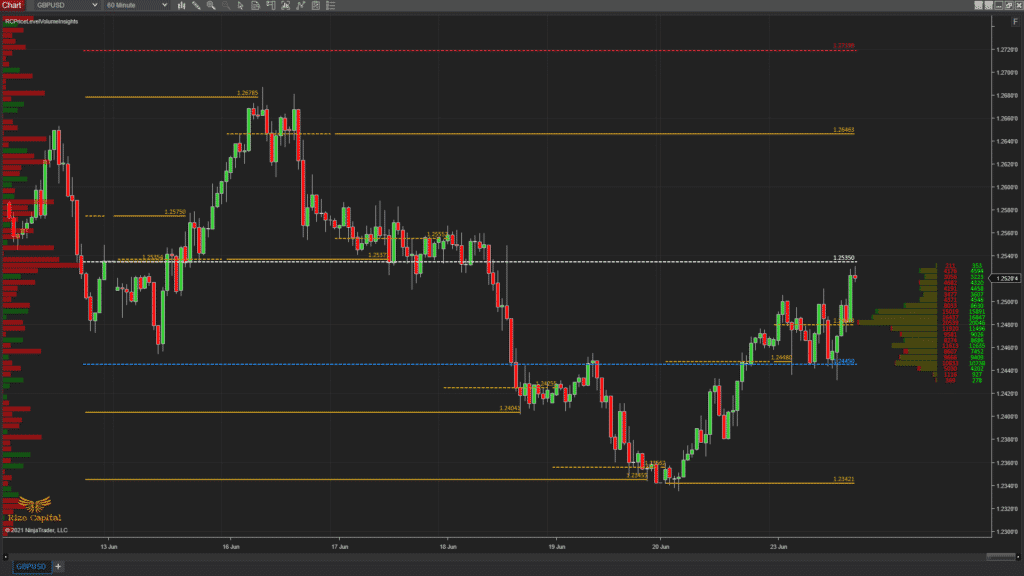

Ninjatrader day trading indicators are crucial tools that help traders analyze market information and make informed choices. These indicators can be built on various data points, like volume, price and even time. Indicators like Bollinger Bands (Bollinger Averages) and the relative Strength Index (RSI), are very popular. The traders can utilize these indicators to spot trends, determine the level of volatility, and establish entry and exit points.

It’s crucial to start with reliable indicators for new traders in order to prevent the danger of having too much information. Moving averages, for example can be a good beginning point since they smooth price data to help highlight trends throughout time. Once traders have a better understanding and confident, they may incorporate other indicators to improve their understanding.

Ninjatrader Day Trading signals – What are their roles?

Ninjatrader day trading signals are generated by analyzing predetermined criteria established by the trader. These signals notify traders to the possibility of opportunities to purchase or sell on the market. Signals may be based on the use of a single indicator or combination of indicators, allowing for an extensive market analysis.

The ability of Ninjatrader’s software to automate signals is among its benefits for day traders. Automating trading signals can reduce emotional bias and ensure that trades are made based on objective criteria. Traders can backtest their signals with past data to test their efficacy before using the signals in live trading.

Crafting Effective Ninjatrader Day Trading Strategies

A well-designed trading strategy is crucial to earn steady profit. Ninjatrader day trading strategies can range from simple to complex, depending on the trader’s experience and risk tolerance. Basic strategies might include using moving averages for trend detection and a stop-loss order to control risks. Some advanced strategies include the use of multiple indicators, complex rules for entry and exit, and automated trades.

It is crucial to consider the market conditions and the goals of the trader when creating a strategy to trade day-to-day. Strategies should be able adapt to changing market conditions. For instance, what works in a trending environment might not work in a range bound market. Continuously reviewing and tweaking strategies can help maintain their effectiveness over time.

Building Robust Ninjatrader Day Trading Systems

A Ninjatrader day trading system is a comprehensive strategy that integrates indicators, signals, and strategies into a single framework. They can be automatic or manual. The trader is able to execute trades by using signals.

Automated systems provide many advantages. They offer increased efficiency, lower emotional trading and allow you to thoroughly test strategies. However, there are some risks associated with them, including system errors and unanticipated conditions on the market. It is vital for traders to regularly monitor their systems and be ready to intervene whenever needed.

Overcoming Common Challenges in Day Trading

Day trading, while potentially lucrative, is not without the potential for problems. New traders can face problems because of unrealistic expectations about trading, reliance of random indicators and emotions in decisions. It’s essential to have realistic expectations and a good understanding of the markets to be able to conquer these difficulties.

Success in day trading is dependent on the management of risk. Risk capital is money traders can afford to lose without compromising their financial security. Making stop-loss orders as well as position sizing can help manage the risk and safeguard the investment.

The Importance of High-Quality Trading Tools

It is essential that you have access to quality trading tools for day trading. IndicatorSmart for example, provides premium Ninjatrader Day Trading indicators, systems, and signals to give traders with the best sources. These tools are able to improve market analysis, improve the decision-making process and improve trading outcomes.

Conclusion

Ninjatrader offers a robust platform for day traders, providing an array of tools and features to enhance the performance of trading. Ninjatrader’s day trading indicators as well as indicators, strategies and systems can assist traders to develop a more comprehensive market perspective by understanding and using them. Day trading success demands constant learning, flexibility, and effective resource use. The right tools and mentality will help traders navigate daily trading obstacles and reach their financial goals.